Your Trusted Source for Online Pharmacy Reviews

Explore the best options for online pharmacy services with honest reviews and expert advice.

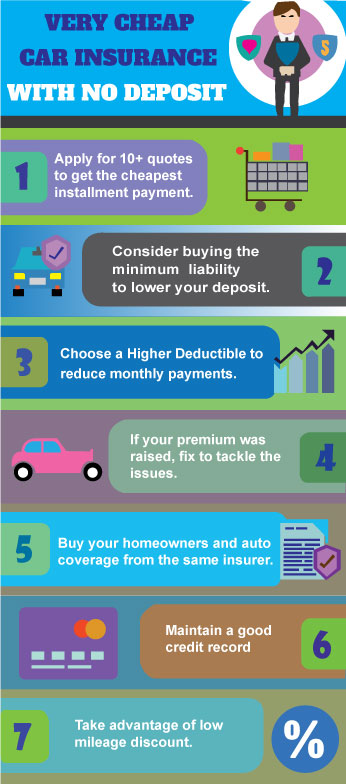

Cheap Insurance Hacks You Didn't Know You Needed

Unlock hidden savings with these genius insurance hacks you never knew you needed! Your wallet will thank you later.

10 Uncommon Ways to Lower Your Insurance Premiums

Finding ways to lower your insurance premiums can often feel like a daunting task. However, there are several uncommon strategies you can employ that might yield significant savings. For instance, consider bundling your insurance policies, which means having multiple types of coverage with the same provider. This often leads to discounts on your total premium amount. Moreover, ensuring that your credit score is in good standing can also positively impact your insurance premium, as insurers may offer lower rates to clients with a history of responsible financial management.

Another innovative method to decrease your insurance premiums is to increase your deductible. By opting for a higher deductible, you agree to pay more out of pocket in the event of a claim, which can result in a lower premium. Additionally, installing security measures, such as a home alarm system or surveillance cameras, can help lower your rates. Many insurance companies reward customers who actively take steps to protect their property. Lastly, participating in wellness programs often offered by health insurers can lead to reduced premiums, proving that a healthy lifestyle can be financially beneficial.

Are You Overpaying? 5 Insurance Discounts You Might Be Missing

Are you feeling the financial pinch when it comes to your insurance premiums? It’s possible that you’re overpaying without even realizing it. Many insurance companies offer a variety of discounts that can significantly reduce your costs, yet countless consumers fail to take advantage of them. Here are five common insurance discounts you might be missing that could help you save money:

- Bundle Discounts: If you have multiple insurance policies, such as auto and home insurance, check to see if your provider offers a bundling discount. This can often lead to significant savings.

- Safe Driver Discounts: Maintaining a clean driving record can qualify you for discounts on your auto insurance.

- Safety Equipment Discounts: If your vehicle has safety features like anti-lock brakes, airbags, or electronic stability control, you may be eligible for further reductions.

- Membership Discounts: Some insurers offer discounts for being a member of certain organizations or professional groups, so check your affiliations.

- Good Student Discounts: Students with good grades may also qualify for lower premiums on their parents' auto insurance.

The Ultimate Guide to Insurance Hacks: Save Big Without Sacrificing Coverage

In today's fast-paced world, finding ways to save on insurance without compromising coverage is more crucial than ever. Whether it’s auto, home, or health insurance, there are numerous insurance hacks that can help you keep your premiums low while ensuring you're adequately protected. One effective strategy is to regularly shop around for quotes. Many insurers offer competitive rates and discounts, but often, policies change frequently. By comparing quotes at least once a year, you can identify potential savings or better coverage options. Additionally, consider bundling your policies; many insurers provide significant discounts when you purchase multiple types of insurance from the same provider.

Another valuable hack is to review and adjust your deductibles. Increasing your deductible can lower your premium, but it's essential to choose a deductible that aligns with your financial situation. Furthermore, don't overlook available discounts. Insurers often provide savings for good driving records, low mileage, home security systems, and even affiliation discounts with certain organizations. Additionally, taking advantage of defensive driving courses can yield further premium reductions. Implement these insurance hacks systematically, and you can see substantial savings without sacrificing the quality of your coverage.