Your Trusted Source for Online Pharmacy Reviews

Explore the best options for online pharmacy services with honest reviews and expert advice.

Secrets to Slashing Your Auto Insurance Costs

Discover expert tips to cut your auto insurance costs! Unlock savings today and drive down your expenses with our proven secrets.

Top 5 Tips for Lowering Your Auto Insurance Premiums

Lowering your auto insurance premiums can be a straightforward process if you follow the right strategies. Here are the Top 5 Tips for Lowering Your Auto Insurance Premiums that can help you save money while maintaining adequate coverage:

- Shop Around for Quotes: The first step in finding affordable auto insurance is to compare quotes from multiple insurers. Rates can vary significantly between companies, so take the time to research and obtain at least three to five quotes before making a decision.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premium. Just make sure you choose a deductible amount that you can comfortably pay in the event of a claim.

- Take Advantage of Discounts: Most insurance companies offer various discounts for safe driving, bundling policies, or being a loyal customer. Check with your insurer to see what discounts you may be eligible for.

- Maintain a Good Credit Score: Your credit score can influence your auto insurance rate. By keeping your credit in good shape, you may be able to secure a lower premium.

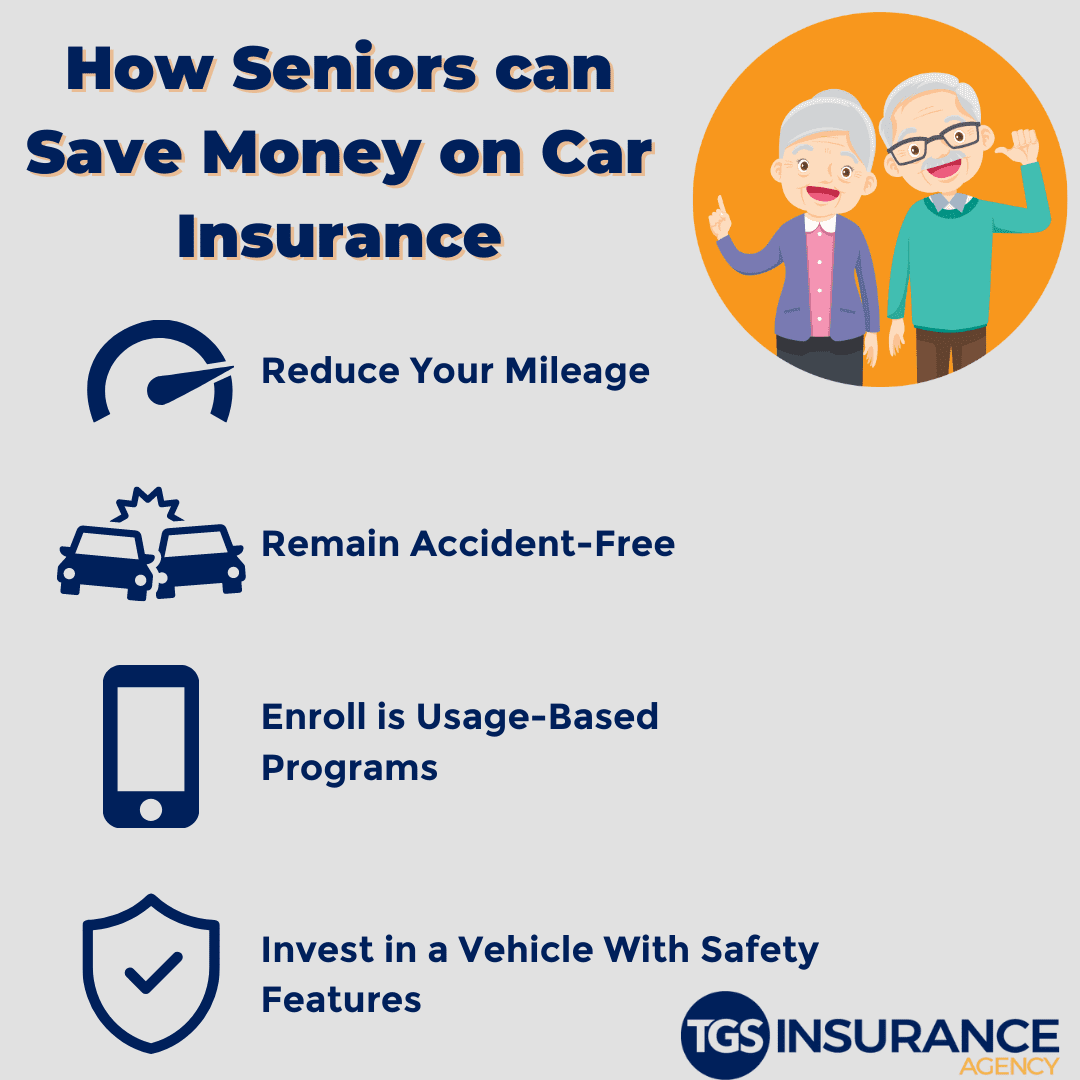

- Consider Usage-Based Insurance: If you don’t drive frequently, consider a usage-based insurance plan that tracks your mileage. This could significantly reduce your premiums if you are a low-mileage driver.

What Factors Influence Your Auto Insurance Rates?

When it comes to determining auto insurance rates, several key factors play a crucial role. Firstly, your driving history is a significant influence; insurers often review your record for accidents, traffic violations, and claims made in the past. Additionally, the type of vehicle you drive can impact your premium. Cars that are frequently stolen or known for high repair costs typically result in higher rates. Other factors include your age and gender, as statistically, certain demographics tend to file more claims.

Another important aspect is location. Areas with high traffic congestion or elevated crime rates may result in increased premiums. Furthermore, the coverage levels you choose, such as comprehensive versus liability, will directly affect your rate. Lastly, factors such as credit score and annual mileage are also taken into account. To summarize, auto insurance rates are influenced by a combination of personal and vehicle-related factors that insurers assess to determine the risk associated with each policyholder.

How to Take Advantage of Discounts to Reduce Your Auto Insurance Costs

Finding ways to lower your auto insurance costs can often feel overwhelming, but taking advantage of discounts can make a significant difference. Many insurance companies offer a variety of discounts that can help you save money. It’s essential to understand what discounts are available to you. For instance, some common discounts include multi-policy discounts, where bundling your auto insurance with home or renters insurance results in savings. Additionally, maintaining a clean driving record can qualify you for a safe driver discount. Always ask your insurance provider about the specific discounts available and how you can benefit from them.

Another effective strategy to reduce your auto insurance costs is to regularly review your policy and update it as needed. Changes in your life circumstances can make you eligible for additional discounts. For example, if you have recently completed a defensive driving course or your teenager has reached a certain age, you may gain access to further savings. Furthermore, consider opting for a higher deductible on your policy if you can afford it, as this often results in lower premiums. By staying informed about available discounts and regularly assessing your coverage, you can significantly reduce your auto insurance expenses.