Your Trusted Source for Online Pharmacy Reviews

Explore the best options for online pharmacy services with honest reviews and expert advice.

Drive Down Premiums: Fun Ways to Score Insurance Discounts

Unlock fun insurance discounts with our tips! Drive down premiums today and save big on your coverage – start your savings journey now!

Unlocking Savings: 7 Creative Ways to Lower Your Insurance Premiums

When it comes to managing household expenses, one area that can often feel overwhelming is insurance premiums. However, with a bit of creativity and diligence, you can unlock substantial savings. Here are 7 creative ways to lower your insurance premiums that may go unnoticed. First, consider bundling your policies. Many insurance providers offer discounts if you purchase multiple types of coverage from them, such as home and auto insurance. Additionally, reviewing your policy annually allows you to adjust coverage to match your current needs, potentially leading to lower costs.

Another effective strategy is to take advantage of discounts that you may not be aware of. For instance, maintaining a good credit score, enrolling in a defensive driving course, or installing security devices in your home can all contribute to a decrease in your premiums. Additionally, increasing your deductibles can sometimes yield lower monthly payments, although it’s crucial to ensure you can cover the deductible in case of a claim. By incorporating these methods, you can significantly reduce your insurance expenses while still maintaining adequate coverage.

Are You Missing Out? Top Insurance Discounts You Didn't Know Existed

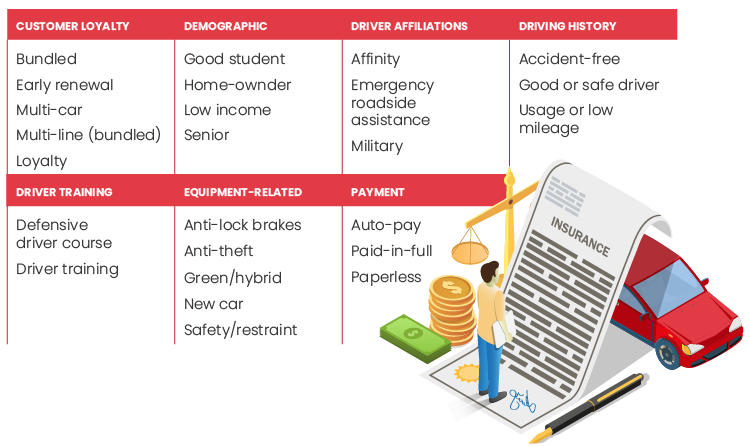

Many consumers are unaware that they might be missing out on significant savings when it comes to their insurance premiums. Insurance discounts can vary widely depending on the provider, but some of the most common discounts include multi-policy discounts, which reward customers who bundle their home and auto insurance together. Additionally, many insurers offer safe driver discounts for those with a clean driving record, as well as discounts for vehicles equipped with safety features. If you're not actively seeking these opportunities, you could be leaving money on the table.

Aside from the typical discounts, there are several lesser-known insurance discounts that could further lighten your financial load. For example, did you know that some insurance companies offer students discounts for maintaining a certain GPA? Furthermore, organizations like professional associations, alumni groups, and even certain membership clubs, such as AAA, often provide exclusive discounts on insurance. Lastly, asking about loyalty discounts can also be beneficial, as many insurers reward long-term customers with reduced rates. Don't hesitate to inquire about all possible discounts; you might be surprised by what you uncover!

How Safe Driving Can Transform Your Insurance Costs: Tips and Tricks

How safe driving can significantly reduce your insurance costs cannot be overstated. Insurance companies often offer lower premiums to drivers with a clean driving record, as they are deemed less risky. By prioritizing safety behind the wheel, you not only protect yourself and others but also position yourself to save considerably on your auto insurance. This means adhering to traffic laws, avoiding distractions, and driving defensively. The following tips will help you cultivate better driving habits and potentially lead to lower insurance rates:

- Maintain a consistent speed and adhere to speed limits.

- Always wear your seatbelt.

- Keep a safe distance from other vehicles.

In addition to safe driving practices, another effective way to lower your insurance costs is to take advantage of discounts offered by your insurance provider. Many companies provide incentives for completing driving safety courses or maintaining a claim-free record. Regularly review your policy to ensure that you are receiving these discounts. Furthermore, consider using technology to your advantage; apps and devices that monitor driving habits can lead to further discounts when shared with your insurer. By implementing these tips and tricks, you can transform your driving habits and enjoy substantial savings on your insurance premiums.