Your Trusted Source for Online Pharmacy Reviews

Explore the best options for online pharmacy services with honest reviews and expert advice.

Insurance Quotes: The Secret to Saving Big

Unlock huge savings on insurance! Discover insider tips and tricks for finding the best quotes today. Your wallet will thank you!

Top Tips for Finding the Best Insurance Quotes

Finding the best insurance quotes can be daunting, but a few strategic steps can simplify the process. Start by researching different insurance providers to understand their coverage options and customer reviews. Websites like Geico and State Farm offer tools for comparing rates and coverage. Consider using online comparison tools that aggregate information from various insurers, allowing you to quickly compare prices. Additionally, don’t hesitate to reach out to local agents, as they can provide personalized service and might have access to exclusive deals.

Next, ensure you are fully aware of your coverage needs before requesting quotes. This includes evaluating what type of insurance you require, whether it's auto, home, or health insurance. Be honest about your driving record or any claims history, as this information impacts the quotes you receive. Additionally, consider bundling insurance policies with the same provider, as many companies offer discounts for multiple policies. To better understand how different factors affect your quotes, check resources like Insure.com for guidance.

How to Compare Insurance Quotes Like a Pro

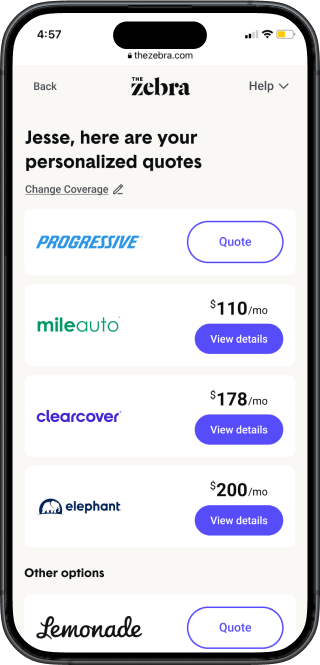

Comparing insurance quotes is essential for finding the best coverage at the most affordable price. To start, gather multiple quotes from various insurance providers. Make sure to compare similar policies, as differences in coverage can significantly impact the premium. A good starting point is to use comparison websites like ValuePenguin or Insure.com. These platforms allow you to input your information once and receive quotes from different insurers, saving you time while ensuring you're getting a comprehensive view of the market.

Once you have your quotes, it's time to delve deeper into the details. Pay attention to factors such as deductibles, coverage limits, and additional benefits. Don't forget to check the financial stability of the insurance companies by looking at ratings from sources like A.M. Best. It’s crucial to ensure the insurer can pay out claims when needed. Lastly, read customer reviews and experiences to gauge the service quality. By taking these steps, you can compare insurance quotes like a pro and make an informed decision that suits your needs.

What Factors Influence Insurance Quotes and How to Lower Them?

Understanding the factors that influence insurance quotes is essential for anyone seeking to save on premiums. Various aspects come into play when insurance companies calculate quotes, including location, age, driving history, and credit score. For instance, individuals residing in urban areas often face higher rates due to increased risk of theft or accidents. Similarly, younger drivers typically encounter steeper costs as they lack the extensive driving experience. Additionally, a poor credit score can lead to elevated premiums, as it may indicate a higher likelihood of filing claims. For more in-depth guidance, check out this article from NerdWallet.

Lowering your insurance quotes can be achieved through several effective strategies. Start by shopping around and comparing quotes from different insurers, as rates can vary widely. Additionally, consider increasing your deductible, which can lead to lower monthly payments. Maintaining a clean driving record and taking advantage of safe driver discounts can also substantially reduce rates. It's wise to regularly review your coverage needs; sometimes, bundling policies or simply asking for discounts can yield savings. For more tips on reducing insurance costs, visit Bankrate.