Your Trusted Source for Online Pharmacy Reviews

Explore the best options for online pharmacy services with honest reviews and expert advice.

Why Whole Life Insurance Is Like a Fine Wine: It Gets Better with Time

Discover why whole life insurance improves like fine wine, gaining value and benefits over time. Uncover the secrets to smart financial planning!

The Long-Term Benefits of Whole Life Insurance: Aging Gracefully Like Fine Wine

Whole life insurance is not just a policy; it's a smart financial strategy that provides long-lasting benefits as you continue on your life journey. Much like fine wine that improves with age, whole life insurance offers a stable cash value accumulation that grows over time, offering financial security. As you age, this policy can become a valuable asset, providing liquidity and allowing you to tap into your cash value through loans or withdrawals when needed. This means that you can navigate life's uncertainties with confidence, knowing you have a safety net that aligns with your long-term financial and estate planning goals.

Additionally, one of the standout features of whole life insurance is its guaranteed death benefit, which ensures that your loved ones are financially protected even in your absence. This added level of security allows you to age gracefully, knowing that your family will be taken care of and their financial future secured. As you appreciate the beauty of life, it's essential to consider how whole life insurance can facilitate peace of mind, acting as a financial cornerstone for your estate plan, much like a fine wine that matures into something exceptional, providing richness and depth to your legacy.

How Whole Life Insurance Grows in Value Over Time: A Vintage Investment

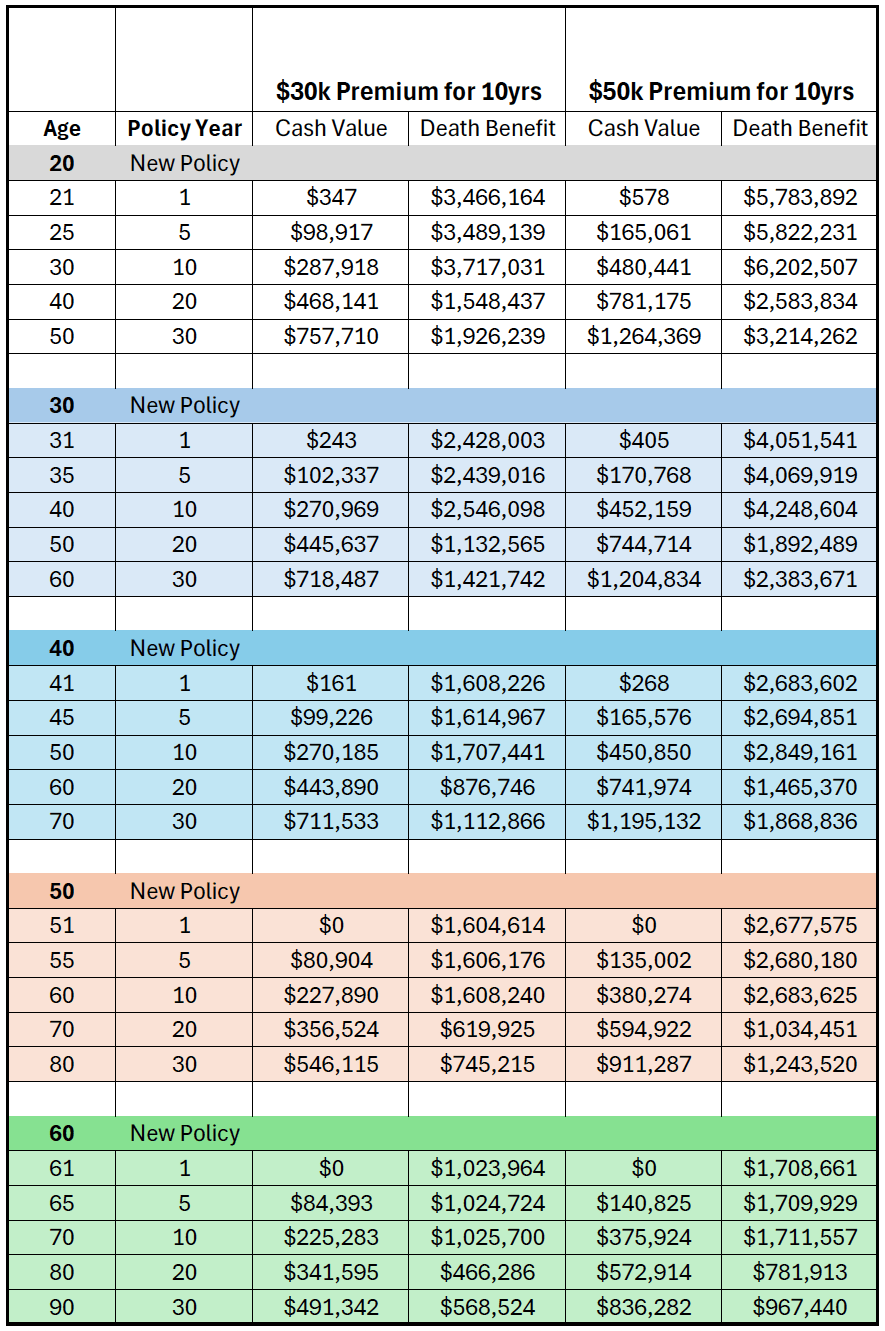

Whole life insurance is more than just a safety net; it's a vintage investment that grows in value over time. Unlike term life policies that provide coverage for a specified period without any cash value, whole life insurance includes a savings component known as the cash value. This cash value accumulates at a guaranteed rate, providing policyholders with an investment vehicle that offers both security and growth. Over the years, as premiums are paid, a portion of these payments contributes to the cash value, which typically grows on a tax-deferred basis, meaning you won't pay taxes on the growth until you withdraw it.

As the policy matures, the cash value can be accessed in several ways, including loans or withdrawals, allowing for flexible financial planning. Furthermore, many insurance companies provide dividends to policyholders, which can also increase the cash value of the policy. This growth makes whole life insurance not just a protective measure, but a long-term financial strategy. In a world where traditional investments can be volatile, whole life insurance stands out as a stable and predictable option, reflecting its status as a vintage investment that can provide security and growth for future generations.

Why Choosing Whole Life Insurance is a Timeless Decision for Your Financial Future

Whole life insurance is not just a policy; it's a financial foundation that provides stability and peace of mind. Unlike term life insurance, which only covers a specified period, whole life insurance offers lifelong protection as long as premiums are paid. This makes it a timeless decision for those looking to secure their financial future. Additionally, whole life policies accumulate cash value over time, which can serve as a valuable asset for emergency funds, loans, or retirement planning. With a guaranteed death benefit and structured growth, you not only protect your beneficiaries but also create a financial tool that can support your goals.

Investing in whole life insurance can also provide significant tax benefits. The cash value growth is tax-deferred, allowing you to enjoy compounding interest without immediate tax consequences. Furthermore, when the time comes, your beneficiaries receive the death benefit free from income tax, ensuring that they are fully supported without the burden of taxes. By choosing whole life insurance, you are not just making an insurance purchase; you are making a timeless decision that prioritizes both your family’s security and your long-term financial well-being.