Your Trusted Source for Online Pharmacy Reviews

Explore the best options for online pharmacy services with honest reviews and expert advice.

Insurance Quotes: The Treasure Map to Saving Big

Discover the secrets to slashing your insurance costs! Uncover the ultimate guide to finding unbeatable insurance quotes today!

How to Navigate the Insurance Quote Maze for Maximum Savings

Navigating the insurance quote maze can feel daunting, but with the right approach, you can uncover significant savings. Start by gathering multiple quotes from different providers. Many companies offer online tools that allow you to input your information once and receive quotes from various insurers. This not only saves time but also lets you compare coverage options and premium costs side by side. Remember to pay attention to the coverage limits and deductibles, as the cheapest quote might not always provide the best protection.

Once you have your quotes, take the time to evaluate them carefully. Look for discounts that may apply to your situation, such as bundling policies, loyalty discounts, or safe driver rewards. Additionally, don't hesitate to negotiate with insurers; a simple phone call can sometimes lead to lower quotes or enhanced coverage options. Lastly, ensure that you review your quotes annually, as your needs and the market conditions may change, allowing you to potentially navigate back through the quote maze for even more savings.

The Ultimate Guide to Comparing Insurance Quotes: Finding Your Best Deal

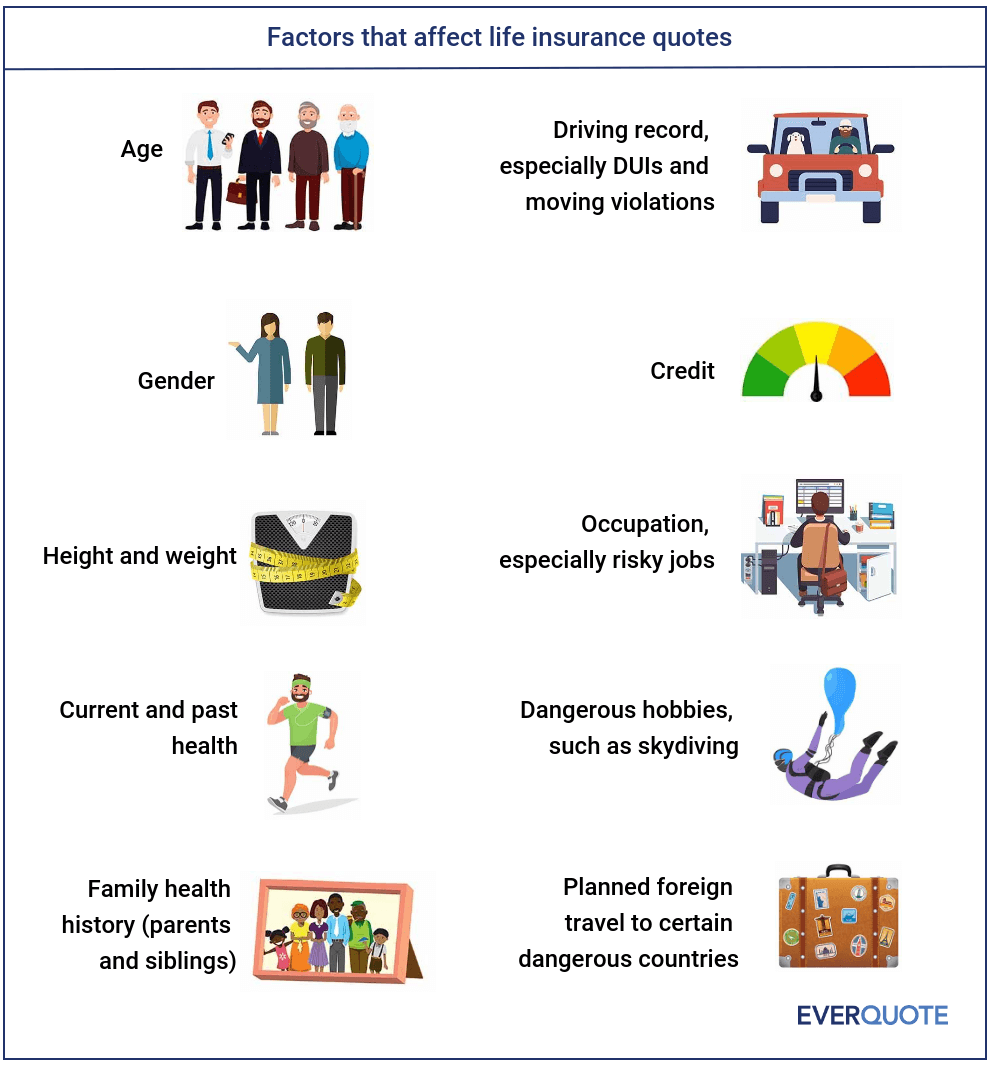

Comparing insurance quotes is an essential step in securing the best deal for your coverage needs. By gathering and analyzing quotes from multiple insurance providers, you can identify the policy that offers the most value for your money. Start by collecting quotes from at least three different insurers. This process typically involves providing personal information such as your age, location, driving history, and coverage requirements. Utilize online tools or consult an insurance broker to streamline this process and ensure you aren’t missing out on competitive pricing.

Once you have obtained several quotes, it’s crucial to evaluate them beyond just the price. Consider the coverage limits, exclusions, and deductibles associated with each policy. Create a comparison chart to easily highlight the differences, focusing on three main factors: premium costs, coverage options, and customer service ratings. By following these steps and prioritizing thorough research, you'll position yourself to make an informed decision and ultimately find the best insurance deal tailored to your needs.

Common Insurance Quote Myths Debunked: What You Really Need to Know

When it comes to insurance quotes, many individuals fall prey to common myths that can cloud their judgment and lead to poor decisions. One prevalent myth is that the cheapest quote is always the best option. While finding affordable coverage is crucial, the lowest price often indicates lower coverage limits or higher deductibles. It's essential to assess the overall value of a policy, considering not just the cost but also the coverage features and customer service quality. Remember, a comprehensive policy may save you more in the long run by preventing unexpected out-of-pocket expenses.

Another widespread misconception is that all insurance quotes are created equal. In reality, quotes can vary significantly from one provider to another due to differences in underwriting criteria, risk assessment, and target markets. Potential buyers should obtain multiple quotes and carefully review each policy's coverage limits, exclusions, and endorsements. Additionally, factors such as your credit score, claims history, and even your geographic location can influence your premiums. Understanding these variables is essential for making informed decisions about your insurance needs.